尔必达记忆体于今年2月底申请破产保护。那么这个总部位于东京的芯片厂商,为何会成为当前科技界讨论最热的并购案?这些潜在的收购者从韩国和日本的科技公司到美国的私募公司TPG资本,都不是对尔必达的生产能力,或者是芯片生产感兴趣,他们觊觎的是尔必达为iPhone和iPad生产的芯片组合。而他们想要的不过是不要让对方抢占了先机。

尔必达记忆体于今年2月底申请破产保护。那么这个总部位于东京的芯片厂商,为何会成为当前科技界讨论最热的并购案?这些潜在的收购者从韩国和日本的科技公司到美国的私募公司TPG资本,都不是对尔必达的生产能力,或者是芯片生产感兴趣,他们觊觎的是尔必达为iPhone和iPad生产的芯片组合。而他们想要的不过是不要让对方抢占了先机。

韩国半导体公司SK Hynix,世界第二大记忆芯片厂商在3月30日宣布将要参与竞购尔必达,并且有可能与日本东芝合作。据知情人士透露,TPG资本也计划参加这次竞购。根据日经产业新闻的报道,美光科技(Micron Technology)可能也会参加。

不管谁最后摘得尔必达,都将继承尔必达制造移动设备芯片的技术,并且有可能代替三星,成为世界上最大的记忆芯片厂商。BGC合伙人,亚洲股票销售经理Amir Anvarzadeh表示,移动DRAM业务,是尔必达所有资产中,唯一值得购买的部分。随着PC市场的行情萧条,尔必达的核心业务,为PC制造记忆芯片,也开始萎缩,因此申请破产保护。

目前,尔必达的资产负债表上有4480亿日元(合55亿美元)的债务,因此,收购尔必达可谓是危险重重。美国美林银行在3月30日的一份报告中指出,要想使尔必达再次具有竞争力,在未来12-18个月中,收购者必须要投入30亿美元的资金。尔必达的债权人为了获得一些补偿,至少会提出30-40亿美元的债务赔偿。这样一来,美国银行总结道,尔必达的竞标价大概只有20亿美元或者更少。

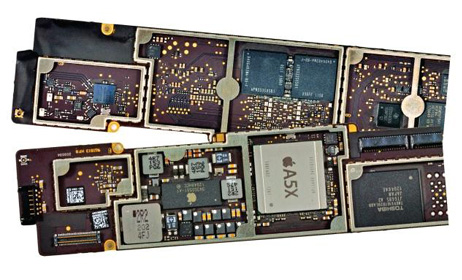

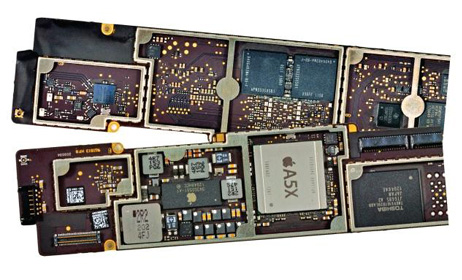

Anvarzadeh表示,尔必达生产DRAM芯片的工厂在广岛市,大约有40%是为苹果提供的。东阳证券分析师Park Hyum表示,尔必达的DRAM技术在全球都是比较出名的。根据一家IT研究公司Gartner的调查,苹果去年取代惠普成为最大的芯片买家。与PC的DRAM芯片不同,移动DRAM芯片是根据移动厂家的特定要求制造的。

根据研究机构TrendForce表示,去年第四季度,Micron在移动DRAM市场占据了7.3%的份额。东芝只生产一种完全不同的芯片——资料存储型芯片,收购尔必达的DRAM资产,会让东芝多元化,并能够进入到一个快速增长的市场。Hynix, Elpida, Toshiba和 Micron拒绝对收购尔必达一事做出评论。据知情人士透露,竞购尔必达的最后期限是在4月27日。

Elpida Memory filed for bankruptcy protection in late February. So how is it that the Tokyo-based chipmaker is now one of the hottest takeover plays in tech? While potential suitors ranging from South Korean and Japanese tech companies to U.S. private equity firm TPG Capital aren’t much interested in Elpida’s workforce or even most of its chip product, they do covet Elpida’s unit that makes chips for Apple’s (AAPL) iPad and iPhone. And they want to make sure their competitors don’t get there first.

Korean semiconductor firm SK Hynix, the world’s second-largest memory chip maker, announced its plans for a takeover offer on March 30, and may team up with Japan’s Toshiba. TPG Capital also plans to make a bid, says a person familiar with the matter, as may Micron Technology (MU), according to a report in Japan’s Nikkei business daily.

Whoever snags the prize will inherit Elpida’s chipmaking technology for mobile devices and perhaps be better positioned to take on Samsung Electronics, the world’s largest memory chip maker. The mobile DRAM (dynamic random-access memory) business is “the only thing worth buying” among Elpida’s assets, says Amir Anvarzadeh, a manager for Asian equity sales at BGC Partners. Elpida filed for bankruptcy after its main business, sales of memory chips for PCs, faltered along with much of the PC industry.

Buying Elpida, which has 448 billion yen ($5.5 billion) of debt on its balance sheet, is far from risk-free. An acquirer would have to spend $3 billion in capital investments during the next 12 to 18 months to make the company competitive again, Bank of America Merrill Lynch (BAC) noted in a March 30 report. Elpida’s creditors probably will seek at least $3 billion to $4 billion to recoup part of what’s owed them. As a result, the company may only attract bids of about $2 billion or less, Bank of America concluded.

Elpida makes its mobile DRAM chips at its plant in Hiroshima, with 40 percent going to Apple, Anvarzadeh says. “Their mobile DRAM technology is perceived as good globally,” says Park Hyun, an analyst at Tong Yang Securities. Apple overtook Hewlett-Packard (HPQ) as the world’s largest chip buyer last year, according to Gartner (IT), an IT research firm. Unlike DRAM chips for PCs, mobile DRAM chips are customized to the specifications required by device makers.

Micron had 7.3 percent of the mobile DRAM market as of the fourth quarter, according to researcher TrendForce. For Toshiba, which produces only NAND flash, a different type of memory chip, buying Elpida’s DRAM assets would allow it to diversify into a fast-growing market, according to TrendForce. Officials from Hynix, Elpida, Toshiba, and Micron declined to comment on takeover speculation. The deadline for final bids for the company is April 27, a person familiar with the matter said.

尔必达记忆体于今年2月底申请破产保护。那么这个总部位于东京的芯片厂商,为何会成为当前科技界讨论最热的并购案?这些潜在的收购者从韩国和日本的科技公司到美国的私募公司TPG资本,都不是对尔必达的生产能力,或者是芯片生产感兴趣,他们觊觎的是尔必达为iPhone和iPad生产的芯片组合。而他们想要的不过是不要让对方抢占了先机。

尔必达记忆体于今年2月底申请破产保护。那么这个总部位于东京的芯片厂商,为何会成为当前科技界讨论最热的并购案?这些潜在的收购者从韩国和日本的科技公司到美国的私募公司TPG资本,都不是对尔必达的生产能力,或者是芯片生产感兴趣,他们觊觎的是尔必达为iPhone和iPad生产的芯片组合。而他们想要的不过是不要让对方抢占了先机。